A CEX-like DEX: an Interview with Polkadex CEO Gautham J

DeFi is rife with great ideas capable of rebalancing financial power dynamics. However, so far, these ideas have proven hard to implement in sustainable and convenient ways.

Take the DEX, or decentralized exchange — this is a cornerstone of DeFi and a place where users are able to trade with each other without sacrificing control over their funds or having to pay exorbitant fees. On paper, it sounds ideal. But when you look at the major DEXes, they are not convenient. DEXes have become synonymous with high transaction fees, long wait times, low network interoperability and manipulation issues.

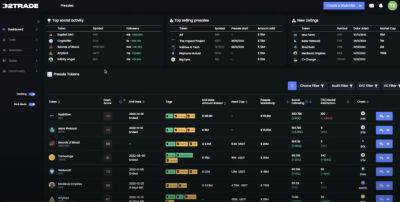

Enter Polkadex. Polkadex is launching the Polkadex Orderbook aiming to give users the best of both DEXes and CEXes, or centralized exchanges. The premise is relatively simple: Orderbook users can enjoy the speed, security and convenience of a CEX without having to hand over control of their assets. But, as with all solutions to complex problems, the creation of the Polkadex Orderbook was not simple. We talked with Polkadex CEO Gautham J to get the inside scoop on the nascent platform and how it is poised to elevate the entire DeFi industry.

For a while, we have known that both CEXes and DEXes in their current state are imperfect solutions. CEXes have always had the upper hand when it comes to trading. However, they hold custody over their own user’s funds. Centralized control over funds exposes users’ assets to risk due to potential security threats or even defaults.

While DEXes solved the custody issue, they created a whole new set of problems for crypto traders with lower functionality, ridiculous network fees, significant manipulation issues like front-running, and limited liquidity and access to tokens.

The recent FTX fiasco and the

Read more on cointelegraph.com