As FTX Bankruptcy Process Begins, French Central Bank Wants Quick Regulation

FTX bankruptcy filings in, French central bank wants quick regulation

Collapsed crypto exchange FTX outlined a "severe liquidity crisis" in official bankruptcy filings released on Tuesday, as regulators opened probes and called for the faster implementation of rules for the hamstrung industry.

FTX's filing to a US bankruptcy court said it was in contact with financial regulators and had appointed five new independent directors at each of its main companies, including Alameda research.

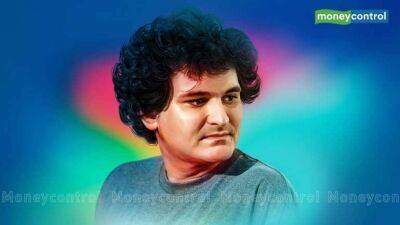

FTX founder and former chief executive Sam Bankman-Fried said he expanded his business too fast and failed to notice signs of trouble at the exchange, whose downfall sent shock waves through the crypto industry, the New York Times reported late on Monday.

"FTX faced a severe liquidity crisis that necessitated the filing of these cases on an emergency basis last Friday," the court filing stated.

"Questions arose about Mr. Bankman-Fried's leadership and the handling of FTX's complex array of assets and businesses under his direction."

FTX also confirmed that it had responded to a cyber attack on Nov. 11, after saying on Saturday it had seen "unauthorized transactions" on its platform.

It filed for bankruptcy protection on Friday in one of the highest-profile crypto blowups after frenzied traders withdrew $6 billion from the platform in just 72 hours and rival exchange Binance abandoned a rescue deal.

The implosion of FTX, once a darling of the crypto industry with a $32 billion valuation as of January, has spurred investigations by the US Justice Department, the Securities and Exchange Commission (SEC) and Commodity Futures Trading Commission (CFTC), a source with knowledge of the investigations told Reuters.

Crypto industry peers and partners have

Read more on ndtv.com

ndtv.com

ndtv.com