Assessing how Ethereum [ETH] fared in all of Q3

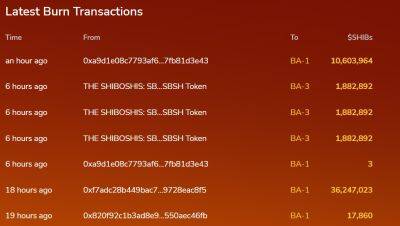

Ethereum’s [ETH] network revenue fell by a massive 86% in the third quarter of 2022, according to the report released by Bankless (an informative site focused on crypto).

Reportedly, Ethereum recorded $1.96 billion in net revenue in the second quarter (Q2). Unfortunately, the third quarter was a paltry $274.12 million.

Source: Token Terminal

Since this was the case, the Merge, which took place on 15 September, was not vital to revive the ETH network. As per the status of the network revenue, Q3 had less ETH demand, with the altcoin king staying bearish for most of its sessions.

Nonetheless, there were a few upticks recorded in the quarter.

According to Bankless, ETH active addresses picked up a 3.09% increase from the previous quarter. This led the number of unique wallet addresses to hit 506,384.

Additionally, other positives accompanied the quarter. A notable one was the exceptional surge in ETH staking. Bankless related the report to Nansen data, which showed that the deposit contract surged 80% to 14.1 million. Of these 14.1 million, there were 442,00 unique validators and 84,600 unique depositors.

Source: Nansen

Interestingly, much of this staking increment could be attributed to Lido Finance [LDO]. Besides offering a liquidity pool for ETH participants, LDO was one of the best-performing cryptocurrencies of the quarter, especially before the Merge. The Lido protocol accounted for 4.25 million out of the depositors.

Another aspect where Ethereum thrived was the Layer-Two (L2) ecosystem. The report stated that the Total Value Locked (TVL) of L2 protocols increased tremendously from 2.40 billion to 4.73 billion.

This value represented a 97% increase from the second quarter. This may not be surprising as protocols like

Read more on ambcrypto.com