Banking turmoil was not a crisis but 'the downside risks are real,' IIF boss warns

The banking sector turmoil that led to the collapse of several lenders was not a systemic crisis and has now subsided, according to Tim Adams, CEO of the Institute of International Finance.

The fall of Silicon Valley Bank in early March — the largest banking failure since the global financial crisis — triggered a wave of market panic that swept through the sector in Europe and the U.S.

A flight of shareholders and depositors culminated in the downfall of Credit Suisse, with Swiss authorities brokering the emergency rescue of the 167-year-old institution by domestic rival UBS.

The smaller Signature Bank was closed by regulators stateside, while Wall Street giants stepped in to make $30 billion of deposits at First Republic, buying the regional lender time to establish a survival plan.

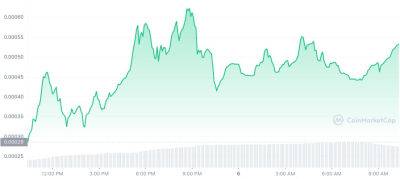

Markets have since stabilized, leading many to conclude that the problems were unique to the stricken banks and do not pose a systemic risk. However, the ripple effect has dented the economic outlook in many advanced economies.

Speaking to CNBC on the sidelines of the International Monetary Fund Spring Meetings in Washington D.C. on Tuesday, Adams said the March chaos was a «period of market turmoil or turbulence,» but dismissed the notion that it was a «crisis.»

«We have over 4,000 banks in the United States, we have about 10,000 banks globally that are part of SWIFT and 35,000 financial institutions around the world — 99.999% of them opened their doors over the past month and had no problems whatsoever — [it's] really just a few isolated idiosyncratic institutions,» Adams told CNBC's Joumanna Bercetche.

«So I think it is not a crisis, I think it was market turbulence, it has subsided, it has stabilized, but we need to be vigilant and we

Read more on cnbc.com

cnbc.com

cnbc.com