Best Crypto to Buy Now 19 July – FLEX Coin, Stellar, Cardano

Nasdaq, the premier tech-based stock exchange in the US, announced on Wednesday that it has put its highly anticipated cryptocurrency custody service on hold due to changing regulatory conditions.

Similar to other traditional financial institutions, Nasdaq's decision reflects a growing reluctance to delve into cryptocurrency ventures amidst increased regulatory scrutiny from US regulators.

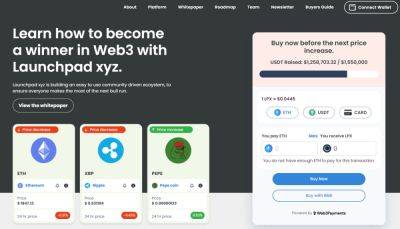

In view of the prevailing macroeconomic conditions, what are the best cryptos to buy now?

For some time, Nasdaq has been at the forefront of traditional financial markets in its pursuit to craft a crypto solution that could cater to the needs of its institutional clientele.

However, plans to unveil custody services for cryptocurrency, a key feature of the digital asset division launched last September, have been shelved due to mounting regulatory ambiguity.

Nasdaq's chief executive, Adena Friedman cited this regulatory uncertainty as the key reason for their decision during an earnings call on Wednesday, .

She stressed the company's preference for operating within clearly delineated regulatory frameworks, noting that recent shifts in both the market opportunity and regulatory landscape contributed to their decision to postpone the launch.

According to Charley Cooper, ex-chief of staff at the CFTC, the Nasdaq move implies a significant hitch.

"The industry needs credible custodians, and Nasdaq, with its widespread recognition and regulatory respect, dropping out will make it more challenging for smaller players hoping to establish their own custody services," he explained.

Though Nasdaq had plans to provide safekeeping services for Bitcoin and Ether, the two leading cryptocurrencies, by the end of June, this goal will now be redirected to assist

Read more on cryptonews.com