Binance Report Shows Downturn in Crypto Market Total Capitalization

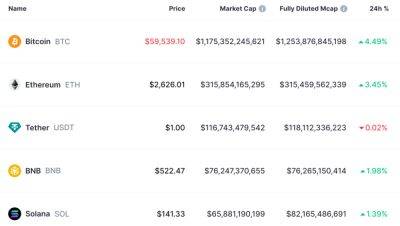

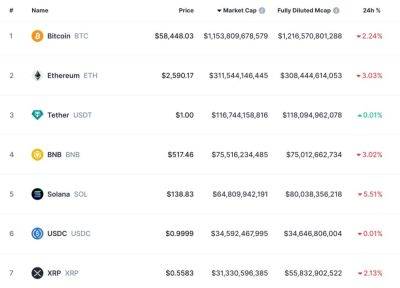

A new Binance study has looked into the recent downturn in the total crypto market capitalization and the structural factors plaguing the sector. Although the market has partially recovered from the sharp decline, it’s still 14% below its peak in March.

The Binance report revealed that the crypto market’s total market capitalization in June witnessed a disastrous downturn of 11.4%, which was around the time of Bitcoin selling pressure from German and US governments.

Recall that the German government offloaded 50,000 BTC confiscated from the operator of the Movie2k website. The Bitcoin holdings were sold in batches, starting on June 19 and ended after the government moved the remaining 3,846 Bitcoin on July 12.

Similarly, the United States government’s movement of 3,940 BTC on June 26 and Mt. Gox’s plan to distribute Bitcoin and Bitcoin Cash for creditor repayments, which started on July 5, worsened the situation.

Meanwhile, the Binance report highlighted another eye-opening fact about the crypto market’s structural weakness.

The researchers created a framework titled “Capital, People, and Technology (CPT)” to analyze the market forces affecting the crypto market. They argue that this framework indicates a steady but slow decline in capital inflows into the market.

Despite a recent upswing, the crypto market has largely been rangebound and is still down from its peak in March.

Curious about what's happening? We introduce our CPT framework and examine a few short- and long-term drivers in this report.

Read on

Read more on cryptonews.com