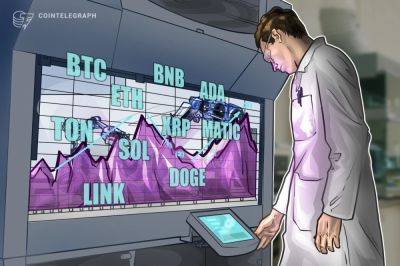

Binance's Spot Market Share Dips to 34.3% – What's Behind the Decline?

According to yesterday's report by cryptocurrency data provider CCData, Binance's spot market share has seen a notable decline, falling from 38.5% in August to 34.3% in September. This marks the seventh consecutive month of decreasing spot market share for the world's leading cryptocurrency exchange.

The slump in Binance's market share isn't isolated to the spot market; the exchange has also lost ground in the derivatives sector.

Meanwhile, competitors like HTX (formerly Huobi), Bybit, and DigiFinex have been gaining the spot trading volume that Binance has lost.

Data from CCData indicates that the slide in Binance's spot market share is not a one-off event but part of a larger trend. In January 2023, Binance's spot market share was as high as 55.2%.

Alongside this, Binance has also seen a worrying reduction in trading volumes. Specifically, the 7-day trading volume for Bitcoin (BTC) on the platform experienced a 57% decline since the beginning of September.

The fall in volume isn't confined to Bitcoin; around 12,230 BTC, or $330 million, as well as about 198,200 Ethereum (ETH), or $323 million, have been withheld from the platform since the beginning of August 2023.

Jacob Joseph, a research analyst at CCData, shed light on the situation, stating, "The halting of zero-fee trading promotion for popular trading pairs, combined with the concerns around the regulatory scrutiny on the exchange, has contributed to this decline."

The analyst highlighted that the end of promotional activities and ongoing legal challenges are important factors affecting Binance's spot market performance.

As Binance's numbers dwindle, alternative exchanges are stepping in to fill the void, capturing the trading volume that Binance has lost. Exchanges

Read more on cryptonews.com