Bitcoin and Ethereum Price Predictions: US Fed Chair Powell Speech in Focus

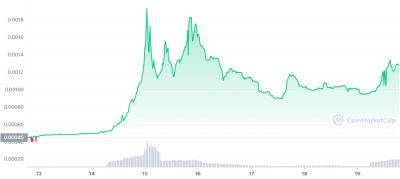

On January 10, Bitcoin (BTC), the world's largest cryptocurrency, extended its upward trend and broke through the $17,200 barrier, as market participants continued to react ahead of the release of US inflation data this week. Ethereum's (ETH) price, on the other hand, was able to surpass $1,300 this week as the overall cryptocurrency market began to improve.

Meanwhile, the value of other well-known cryptocurrencies, such as Dogecoin (DOGE), Ripple (XRP), and Solana (SOL), increased. The next level of resistance for Bitcoin would be $17,400, with $17,050 acting as a support level if the upward trend continues. However, the main reason for the BTC rally could be attributed to lower-than-expected inflation expectations, which are encouraging for cryptocurrency investors.

The cryptocurrency market as a whole is still stable, with Bitcoin and Ether showing a small increase after a big gain yesterday.

In the meantime, the current favorable macroeconomic conditions are also contributing to the growing value of crypto assets, which may be a long-term positive sign for the crypto market.

Markets will watch Federal Reserve Chair Jerome Powell's speech later in the day for hints about monetary policy. Powell is scheduled to speak at a bank conference in Sweden later in the day.

During his speech, Powell is expected to shed more light on the path of interest rates and economic growth. Markets will look for shifts in the Fed chair's combative tone, particularly in light of mounting evidence that US inflation is slowing.

After a significant rate hike hurt the region's markets in 2022, the prospect of a less aggressive Fed is expected to provide much-needed relief to the cryptocurrency markets. After rising interest rates severely

Read more on cryptonews.com