Bitcoin and Other Crypto Prices Pump After US Retail Sales and PPI Inflation Falls More Than Expected

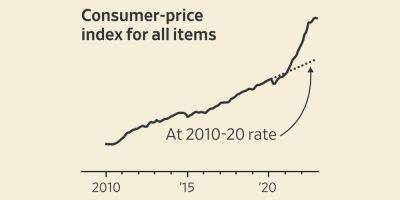

Bitcoin and wider crypto prices are getting a strong tailwind today after the release of the latest US economic data shows softening inflation and slowing retail sales.

Bitcoin at the time of writing is priced at $21,565, up 0.9% and Ethereum is currently 0.85% higher at $1,602.

The closely watched US retail sales figure fell -1.1%, greater than the -0.8% forecast by economists.

Meanwhile, producer price index (PPI) inflation fell to 6.2% as against the headline figure of 6.8% that was expected.

The latest economic data should strengthen the hand of doves at the Federal Reserve to slow down on interest rate rises.

The poor retail sales data suggests that consumers are feeling the pinch of higher prices and are cutting back.

That would have the effect of taking some of the demand out of the economy that was threatening to send inflation spiralling even higher.

Put that another way – it means rising interest rates are already doing the trick in taming inflation

And the PPI reading feeds into earlier inflation data that points to slowing inflation, which in turn will negate the need for the Fed to move more aggressively on interest rates.

On the contrary, it should help to confirm the rationale for the shift in sentiment that has seen a pick up in risk assets such as stocks and crypto.

Bitcoin is now trading comfortably above its 200-day simple moving average and the MACD moving above the signal line. The volume profile shows strong volume at the present price point.

The key target that may confirm that the bear market is over is a successful attack on the $30,000 price, a key area of resistance, last visited in June 2022.

It could be a great time to start accumulating bitcoin and top altcoins such as Ethereum. Solana and

Read more on cryptonews.com