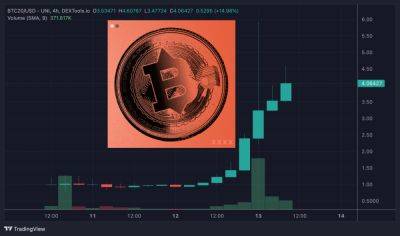

Bitcoin Holds Above $29,000 Following Mixed US Jobs Report – Where Next for the BTC Price?

The Bitcoin (BTC) price is holding within recent ranges to the north of the $29,000 level in the wake of the latest mixed US jobs report for July.

The report revealed that the US economy added 187,000 jobs in July, below the expected gain of 200,000.

Moreover, June’s job gain of 209,000 was revised lower to a job gain of 185,000.

However, a separate survey of households revealed that the unemployment rate had unexpectedly declined to 3.5% from 3.6% in June.

Average hourly earnings growth was also stronger than expected, rising 0.4% MoM in July against expectations for an increase of 0.3%, pushing the YoY rate up to 4.4%.

The lack of reaction in the bitcoin price and broader financial markets to the report was attributed to the fact that there was “something for everyone” in the data.

On the one hand, the rate of job gains in the US is clearly trending lower, with the headline July NFP reading its lowest since early 2021.

That is a sign that heat is coming out of the jobs markets, something the Fed wants to see, as a hot jobs market makes tackling still too-high US inflation more difficult (or impossible, some would say).

But then again, still super low (by historic comparison) unemployment rate and wage growth that remains well above the Fed’s 2.0% inflation target show that the labor market remains too hot for the Fed’s liking.

Investors seem to have taken the view that the latest jobs report doesn’t change the narrative much regarding expectations for Fed tightening.

According to the CME’s Fed Watch Tool, US interest rate futures pricing implies an 86% chance that the central bank leaves rates unchanged at the next meeting in September, a tad higher than prior to the data release.

Markets then assign a roughly 75% chance that

Read more on cryptonews.com