Bitcoin Mining Rig Maker Canaan Secures $50 Million In Preferred Shares Sale

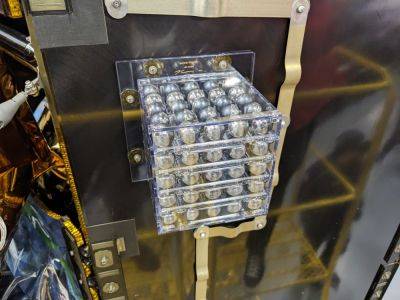

Bitcoin (BTC) mining rig manufacturer, Canaan Inc has raised $50 million in a new funding round by selling preferred shares.

The company disclosed the development in a recent filing at the Securities and Exchange Commission (SEC) stating that funds raised will be deployed to expand research, innovation, and production capacity.

The $50 million raised came from an undisclosed institutional investor after 50,000 series A Canaan shares were issued with convertible preference and at $1,000 each.

“Pursuant to the second tranche of the Preferred Shares Financing, the Company issued 50,000 Preferred Shares at the price of US$1,000.00 per Preferred Share and caused The Bank of New York Mellon to deliver 2,800,000 American depositary shares (“ADSs”), each representing fifteen Class A ordinary shares of the Company, at the price of US$0.00000075 for each ADS.”

The company explained in the filing that funds raised will be deployed to improve its production capacity with special mention of innovation, research, and other corporate purposes.

This latest round of funding comes on the heels of a previous $25 million raised by the company to further its business operations. At the time of disclosure, the firm’s share price was up by 7% but suffered a 31% plunge this month.

As mining activity picked up across the board toward the end of last year, miners recorded increased profits, wiping out the previous year’s losses with the increased revenue.

The company seeks to take advantage of the rush among miners to improve their capacity. This urge is significantly pushed by the upcoming Bitcoin halving which will reduce miner rewards.

Traditionally, Bitcoin halvings are known as a bullish drive in the market. Though mining rewards are slashed,

Read more on cryptonews.com