Bitcoin price consolidation could give way to gains in TON, APE, TWT and AAVE

The United States equities markets shrugged off the hotter-than-expected labor data on Dec. 2 and recovered sharply from their intraday low. This suggests that market observers believe the Federal Reserve may not change its stance of slowing the pace of rate hikes because of the latest jobs data.

Although the FTX crisis broke the positive correlation between the US equities markets and Bitcoin (BTC), the recent strength in the equities markets shows a risk-on sentiment. This could be favorable for the cryptocurrency space and may attract dip buyers.

The broader crypto recovery may pick up steam after more clarity emerges on the extent of damage caused due to the FTX crisis. Until then, bullish price action may be limited to select cryptocurrencies.

Let’s look at the charts of Bitcoin and select altcoins that may be getting ready to start an up-move in the near term.

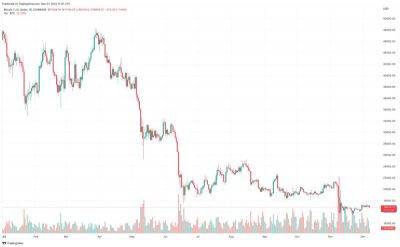

Bitcoin has been trading near the 20-day exponential moving average ($16,963) for the past three days. This suggests a tough battle between the bulls and the bears to gain supremacy.

The major roadblock for the buyers on the upside is $17,622. If bulls catapult the price above this level, it will suggest that the downtrend could be over, The BTC/USDT pair could then race to the psychological level of $20,000. This level may again act as a resistance but if crossed, the pair could rally to $21,500.

Conversely, if the price turns down from $17,622 and breaks below the 20-day EMA, it will suggest that the bears have not yet given up. The pair could thereafter consolidate in a large range between $15,476 and $17,622.

Buyers are defending the 20-EMA on the 4-hour chart but the failure to achieve a strong bounce indicates that demand dries up at higher levels. The bears

Read more on cointelegraph.com