Bitcoin Price Prediction as Non Farm Payroll Data is Announced – Bull Market Starting Soon?

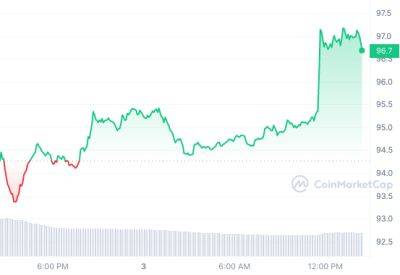

The recent release of the Non-Farm Payroll data has caused a notable impact on the price of Bitcoin.

With the data revealing positive job growth in the United States, market sentiment has favored a bullish outlook for the US dollar.

Therefore, Bitcoin experienced a downward movement in response to the positive report.

Traders and investors are closely analyzing this reaction and assessing its implications for the future trajectory of Bitcoin.

The market's response to the Non-Farm Payroll data highlights the complexity and unpredictability of the cryptocurrency market, reminding us of the need for careful analysis and monitoring of economic indicators when predicting Bitcoin's price movements.

The US Bureau of Labor Statistics (BLS) released the Nonfarm Payroll data for May, reporting a significant increase of 339,000 jobs.

This figure exceeded market expectations, which had anticipated around 190,000 jobs.

Additionally, April's reading was revised higher from 253,000 to 294,000.

Simultaneously, the Unemployment Rate rose to 3.7% from the previous 3.4%, while the Labor Force Participation rate remained steady at 62.6%.

Average Hourly Earnings, a measure of wage inflation, experienced a slight decline from 4.4% to 4.3%.

The BLS highlighted that the number of individuals employed part-time for economic reasons remained relatively unchanged at 3.7 million.

These individuals, who desired full-time employment but could not secure it, either had their hours reduced or could not find full-time jobs.

Market reaction to the positive data was swift.

The US Dollar Index reversed its earlier losses and turned positive, surpassing the 103.50 level. Furthermore, the benchmark 10-year US Treasury bond yield experienced an upward shift,

Read more on cryptonews.com