Bitcoin Price Prediction: Kiyosaki Eyes $135K BTC Amid USD Woes & Saylor's Success

As the Bitcoin market continues its unpredictable journey, notable figures and events hint at potential future movements. Currently trading at $30,377, Bitcoin is witnessing a modest rise of 1.50% this Monday.

However, a backdrop of a weakening US dollar, as pointed out by economist Peter Schiff's dire warnings of an impending recession and inflationary depression, may have significant implications for the cryptocurrency.

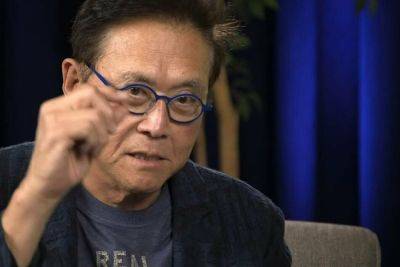

Michael Saylor, a key player in the Bitcoin realm, has come forward with evidence backing the profitability of his Bitcoin strategies. Meanwhile, financial educator Robert Kiyosaki projects a soaring trajectory for gold and anticipates Bitcoin reaching a remarkable $135,000 mark.

Fearing an inflationary slump, a protracted recession, and a possible collapse in demand for the US currency, economist Peter Schiff has given a grave warning.

According to Schiff, the significant national debt and budget deficits will fuel persistently high inflation, which will cause an even more severe and protracted economic collapse.

He challenges the Federal Reserve's approach to combating inflation, contending that the monetary expansion and fiscal measures implemented during the epidemic worsened matters.

According to Schiff, when significant purchasers turn into sellers, the demand for the US dollar—driven mainly by buying Treasuries—would decrease, lowering the currency's value and raising Treasury rates.

The concerning remarks from Schiff against the US dollar might have been causing some positive momentum for Bitcoin today as they are both negatively correlated.

In a recent social media post, Michael Saylor, the founder, and chairman of MicroStrategy, emphasized the success of his company's Bitcoin (BTC) strategy and

Read more on cryptonews.com