Bitcoin Price Prediction: Will BTC Revisit 61.8% Fibonacci Level Following SEC Lawsuit Against Binance

The world's leading cryptocurrency has recently faced a significant challenge as the Securities and Exchange Commission (SEC) filed a lawsuit against Binance, a major cryptocurrency exchange.

This development has sparked concerns and uncertainty in the market, leading to a sharp decline in Bitcoin's price.

Traders and investors are now closely watching the price movements to assess whether Bitcoin will revisit the critical 61.8% Fibonacci retracement level.

This Bitcoin price prediction will analyze the current situation and explore the potential scenarios for Bitcoin's price in the aftermath of the SEC lawsuit against Binance.

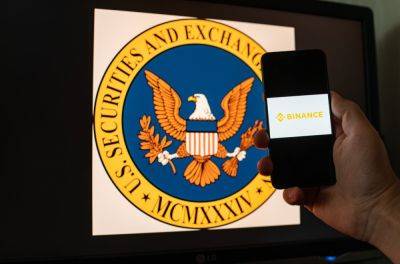

On Monday, the US Securities and Exchange Commission (SEC) complained about Binance, a cryptocurrency exchange led by Changpeng Zhao (CZ).

The SEC alleges that Binance provided staking services and offered unregistered securities to the public, which violates US securities laws.

In the complaint, the SEC identifies 12 crypto tokens as securities. The lawsuit also names Bam Trading Services, the operator of Binance.US, and its parent company Bam Management US Holdings, as defendants.

According to the complaint, Zhao owns 81% of Bam Management.

According to the commission, the defendants have been providing trading access to crypto assets that are marketed and sold as investment contracts, thus qualifying as securities under US law.

Notably, Bitcoin (BTC) and Ether (ETH) are not specifically mentioned in the Binance lawsuit filed on Monday.

However, SEC Chairman Gary Gensler has stated that, apart from Bitcoin, most crypto tokens are considered securities.

When asked about the classification of Ether as a security or commodity during his testimony before the House Financial Services Committee, Gensler

Read more on cryptonews.com