Bitcoin price rally to $19.5K prompts analysts to explore where BTC price might go next

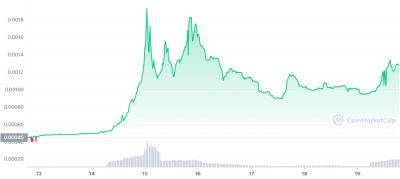

After Bitcoin (BTC) hit a yearly high of $19,501 on Jan. 13, where is it headed next?

Bitcoin is currently witnessing an uptick in bullish momentum after the positively perceived Consumer Price Index (CPI) report was followed by a strong rally across the crypto market.

The recent rally in Bitcoin is creating increased volume levels and higher social engagement on whether the price is in a breakout of fakeout mode.

While the market is still technically in a bear market compared to last week, investor sentiment is improving. According to the Fear and Greed Index, a crypto-specific metric that measures sentiment using five weighted sources, investors’ feelings about the market hit a monthly high.

Bitcoin price is now approaching the psychologically important $20,000 level and many analysts and traders are issuing their thoughts on where BTC price could head next.

Let’s explore a few of these perspectives.

Bitcoin price has yet to recover from its pre-FTX levels, but reached above $19,501 on Jan. 13 for the first time since Nov. 8, 2022. Despite the strength of the recent rally, some analysts believe BTC price needs to reach $21,000 before the current bullish trend can be sustained.

According to Glassnode analysis,

The lack of trading volume around $18,000 shows the weakness in the current on-chain and centralized exchange (CEX) activity. The largest volumes and overall activity seem to surround the $16,000 level, suggesting that is a more solid floor than the current price range. With less volume surrounding levels higher than $20,000, Bitcoin’s rally could be capped at $20,000.

Bitcoin is still facing headwinds including massive exchange layoffs in a tightening macro economy, Gemini and Genesis legal issues and the potential

Read more on cointelegraph.com