Bitcoin price slips under $27K, but data shows BTC whales counter trading DXY strength

As the summer season arrives, an unexpected heatwave is gripping financial markets

This heat is coming in the form of the US Dollar (DXY) which has been on a remarkable uptrend since late April, reaching levels unseen since early March’s banking crisis when the dollar wrecking ball wreaked havoc on asset prices.

This surge in the dollar has raised concerns among market participants due to its high inverse relationship with Bitcoin (BTC), a topic many macro and crypto analysts have discussed repeatedly in 2023.

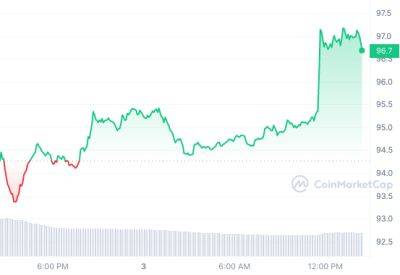

The implications of this inverse correlation means that when the dollar rises, BTC falls and vice versa. The chart below showing the year-to-date performances of DXY (blue line) and BTC (orange line) underscores this relationship a step further.

Notice how, Bitcoin’s 2023’s performance has been propelled by a downward dollar. Not coincidentally, DXY reached its year-to-date low near 100.80 on April 13, nearly the exact date BTC reached its year-to-date high of just over $31,000. Since then, however, both have been trending in opposite directions.

Feelings of unease over what sort of summer could be in store for markets should the dollar’s uptrend continue are certainly justified at present. After all, the last time DXY broke above these levels BTC was trading below the $20,000 mark.

On the surface, this would imply that BTC still has quite a deep correction ahead before any hopes of new year-to-date highs emerge.

Taking a look deeper however, it's clear that some divergent signals beginning to emerge which suggest this dollar rally could be nearing an end.

Let’s take a look at them to see what’s been driving DXY’s recent strength, and zoom in on a notable segment of the market who has remained un-phased by Uncle Sam’s

Read more on cointelegraph.com