BlackRock CEO Larry Fink Highlights Rising Crypto Demand from Gold Investors

BlackRock CEO Larry Fink has expressed optimism about the rising demand for cryptocurrencies among gold investors.

In an interview with CNBC following the release of BlackRock's second-quarter earnings report, Fink stated that "more and more" gold investors have been inquiring about the role of cryptocurrencies over the past five years.

He mentioned the impact of exchange-traded funds (ETFs) in democratizing access to gold, noting that they could have a similar effect on the crypto market.

Fink pointed out the depreciation of the US dollar in recent months and its appreciation over the past five years, emphasizing that an international crypto product could provide a hedge against these fluctuations.

"That's why we believe there are great opportunities and why we're seeing more and more interest. And the interest is broad-based and worldwide."

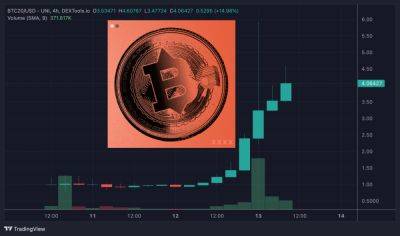

BlackRock filed an application last month to list a spot Bitcoin (BTC) ETF with a surveillance-sharing agreement.

This could be a determining factor in the US Securities and Exchange Commission (SEC) finally approving such a product, after rejecting numerous applications in the past.

According to Fink, BlackRock's foray into the cryptocurrency market aligns with the company's objective of creating user-friendly and cost-effective investment products.

"We believe we have a responsibility to democratize investing. We've done a great job, and the role of ETFs in the world is transforming investing. And we're only at the beginning of that."

Fink previously expressed skepticism about cryptocurrencies in 2017, attributing their popularity to money laundering.

However, client interest and the surging value of cryptocurrencies have prompted BlackRock to explore the possibility of entering the

Read more on cryptonews.com