Cardano ADA Q2 2023: Dapp Transactions Up 49%, TVL Increases 9.7%

Messari, a leading provider of crypto research and insights, has released its Q2 2023 report on Cardano, a prominent Proof-of-Stake (PoS) Layer-1 smart contract network. The report highlights key insights and developments within the Cardano ecosystem, providing a comprehensive overview of its performance, financial status, ecosystem, staking, and decentralization, along with notable community and development events.

Key insights include average daily decentralized application (dapp) transactions being up 49% QoQ, with Minswap experiencing the largest absolute growth. Total Value Locked (TVL) in USD was up 9.7% QoQ and 198.6% YTD, moving Cardano from 34th to 21st in TVL ranking across all chains. Hydra Head, an off-chain mini ledger, continued its development with proposed topologies and a demo shared. Projects like Milkomeda C1, Midnight, Wanchain, and IOG's sidechains team are working towards increased interoperability within the Cardano ecosystem.

The average transaction fee increased 8.5% QoQ from $0.117 to $0.126, still down 50.8% YoY. Daily active addresses declined 4.0% QoQ from 60,200 to 57,800. Average daily transactions were up 1.9% QoQ from 67,500 to 68,800. Cardano's average blockchain load increased from just under 40% in Q1 to over 50% in Q2.

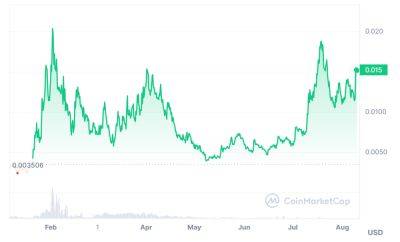

ADA's price pulled back 26.9% QoQ after a 53.5% increase in Q1 but is still up 12.0% YTD. Cardano's Treasury balance grew 8.5% to 1.30 billion ADA during Q2, with the value in USD terms decreasing 20.7% QoQ from $452 million to $358 million.

Cardano's total stablecoin market cap grew 34.9% QoQ from $10.0 million to $13.5 million. Minswap, an automated market maker (AMM), ended Q2 with a TVL of $48.8 million and 32.2% dominance.

There were 1,921 unique stake pool

Read more on blockchain.news

blockchain.news

blockchain.news