CBOE Announces Official Launch Date for Spot Ethereum ETF

The Chicago Board Options Exchange (CBOE) has announced that five spot Ethereum exchange-traded funds (ETFs) will begin trading on July 23, pending regulatory effectiveness.

The announcement follows the approval of rule changes by the United States Securities and Exchange Commission (SEC) on May 23, allowing for the listing of spot Ether ETFs.

However, the launch is subject to final approval of each fund issuer’s respective S-1 registration statements by the regulator.

The five spot Ether ETFs that will commence trading are the 21Shares Core Ethereum ETF, Fidelity Ethereum Fund, Invesco Galaxy Ethereum ETF, VanEck Ethereum ETF, and Franklin Ethereum ETF.

To gain an early market advantage, most of the ETF issuers have announced plans to temporarily waive or discount fees, aiming to compete for market share once the products are available for trading.

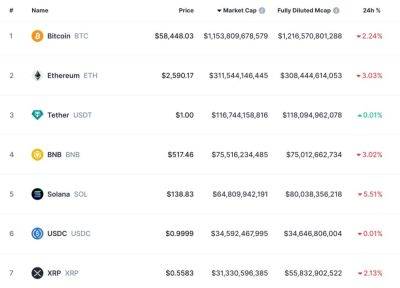

Analysts in the industry predict that Ether ETFs could attract billions of dollars in net inflows in the months following the launch.

The increasing demand from institutional investors seeking to include Ether in their ETFs could potentially lead to a supply crunch.

The Ethereum Exchange Reserve, which tracks the amount of available Ether for purchase on cryptocurrency exchanges, is currently at multi-year lows.

A recent report by Kaiko highlighted Ether’s 1% market depth and suggested that lower liquidity could result in heightened price volatility, potentially causing Ether to outperform Bitcoin in terms of percentage gains.

Tom Dunleavy, an institutional analyst, believes that inflows into Ethereum ETFs could reach $10 billion this year, with capital flows of up to $1 billion per month.

Dunleavy expressed optimism about the price impact and anticipated new all-time highs for Ether

Read more on cryptonews.com