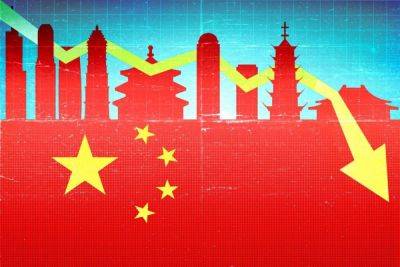

China signals more support for real estate with a 'big change' in tone

BEIJING — China is changing its tone on the struggling real estate sector, paving the way for policy support.

Beijing's crackdown on the once-hot property market has focused on financial risks of speculation and highly indebted developers such as Evergrande. Despite recent government efforts, home sales have slumped as the overall economy slows.

This week, a meeting of top Chinese leaders noted a «great change» in the relationship between supply and demand in the real estate market — and called for policy adjustments. That's according to a CNBC translation of the Chinese readout of a Politburo meeting on Monday.

The readout also removed the phrase «houses are for living in, not for speculation» — frequently used in China as a mantra for a tight policy on the property market.

«For policymakers, the top property-related risk is no longer financial risk, but recession risk,» said Larry Hu, chief China economist at Macquarie.

«In an extremely top-down system like today's China, the tone from the top is much more important than specific policy measures,» Hu said. He expects detailed policy announcements in the coming months.

The first time Chinese officials spoke of changes in real estate supply and demand was at a People's Bank of China press conference on July 14, according to a state media report. Then, the PBOC official hinted at forthcoming property market policies.

This week, the higher-level Politburo meeting readout included similar language.

The statement reflects a «much clearer understanding about the seriousness of the situation,» said Qin Gang, executive director of China real estate research institute ICR. That's according to a CNBC translation of his Mandarin-language remarks.

«This is a big change,» he said.

Read more on cnbc.com cnbc.com

cnbc.com