Coinbase continues effort to get mandamus for SEC response to rulemaking petition

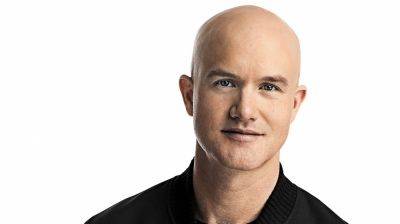

Coinbase has filed a reply in support of its petition for a writ of mandamus to the United States Securities and Exchange Commission (SEC) in its latest move seeking rulemaking from the SEC on digital assets. Coinbase chief legal officer Paul Grewal called the mandamus “the tailor-made remedy for the extraordinary facts.”

Coinbase filed a petition to the SEC in July “requesting that the Commission propose and adopt rules to govern the regulation of securities that are offered and traded via digitally native methods, including potential rules to identify which digital assets are securities.” It provided 50 questions for the agency to consider in formulating rules.

The Coinbase filing on May 22 claimed that the agency has made a decision to reject Coinbase’s July petition but has not made that decision public. Furthermore, the SEC’s inaction is allegedly part of a larger pattern:

Coinbase and the SEC presented arguments concerning the appropriate response time for rulemaking, even with a mandamus writ. Coinbase argued in its new filing that its case was different from others:

When it did not receive a response to the petition by April, Coinbase filed a writ of mandamus, a formal request that the agency be required to respond, in the U.S. Court of Appeals for the Third Circuit. The SEC could respond under the mandamus by rejecting the petition’s call to action. However, doing so would open it up to further legal action to compel rulemaking on digital assets.

Late last night Coinbase replied in the Third Circuit to the SEC’s arguments against our petition for a writ of mandamus. Mandamus is the tailor-made remedy for the extraordinary facts presented here. We continue to appreciate the Court's consideration.

Read more on cointelegraph.com