Crypto Biz: A spotlight on Binance, Galaxy Digital swings to profit, China’s blockchain push

Regulators in the United States have a fresh target on their radar: Binance. The Commodity Futures Trading Commission (CFTC) has sued the world’s biggest crypto exchange by trading volume for regulatory violations. Accusations range from insider trading to concealing office locations around the world to evade authorities’ oversight.

Binance denies the claims, suggesting another court battle between crypto firms and U.S. regulators is just around the corner. On another front, Binance’s U.S. arm must wait to close its $1 billion deal for Voyager Digital’s assets until the Department of Justice decides whether to appeal to Voyager’s bankruptcy plan.

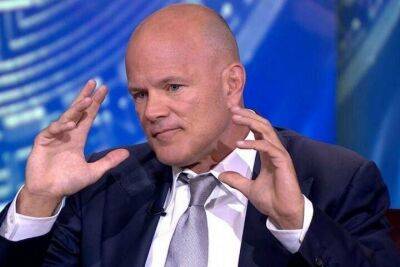

Beyond the courts, signs that the crypto winter is fading away are on the horizon. Billionaire Mike Novogratz’s Galaxy Digital turned a profit after a $1 billion loss in 2022. Meanwhile, China keeps developing its fintech industry, with a strong emphasis on blockchain.

This week’s Crypto Biz examines how Binance is coping with ongoing fear, uncertainty and doubt (FUD) about its business, and how companies are navigating Web3 opportunities and challenges.

Binance CEO Changpeng “CZ” Zhao rejected accusations of market manipulation in response to a CFTC lawsuit, labeling it “an incomplete recitation of facts.” According to Zhao, Binance “trades” in several situations, mainly to convert its crypto revenue to cover expenses in fiat or other cryptocurrencies. The exchange’s CEO also acknowledged that he has two personal accounts at Binance: one for Binance Card and one for crypto holdings. “I eat our own dog food and store my crypto on Binance.com. I also need to convert crypto from time to time to pay for my personal expenses or for the Card,” he added. Zhao said Binance has a 90-day

Read more on cointelegraph.com