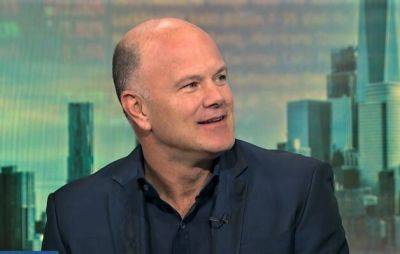

Crypto markets ‘lackadaisical’ as institutional buying slows — Novogratz

Galaxy Digital CEO Mike Novogratz has described the broader crypto market as being “lackadaisical” — or lacking enthusiasm — due mainly to a shying away of institutional investors from cryptocurrencies.

In a June 1 interview with CNBC, Novogratz said that while the relatively small retail buyers add some stability to the market with their modest holdings, the lack of large-scale buyers is becoming a concern.

The claims echo a May 31 report from Coinshare’s head of research James Butterfill, which detailed that institutional buying of digital assets saw outflows totaling $39 million as of last week, the sixth consecutive week of outflows.

Novogratz has however pointed to two significant developments in Asia that may help shift the tide.

First, he pointed out that Chinese social media app WeChat now offers Bitcoin (BTC) price quotes on its app, something he considers a significant milestone given its popularity. At the time of writing WeChat has 1.3 billion monthly active users, according to data from Statista.

Wechat is available for #Bitcoin search and only Bitcoin. A small but big step of China/HK embracing crypto pic.twitter.com/DHq4uqnq5C

Secondly, Novogratz looked to Hong Kong which has now officially begun allowing retail customers to trade crypto on regulated exchanges for the first time, an indication of increasing Asian adoption.

In an interview with Cointelegraph, Tommy Honan, the head of product strategy at Swyftx agreed that the crypto market has very much “fizzled out” over the course of the last month.

“Activity levels among institutional investors are definitely more muted. But it’s not just institutions, retail investors have been hit in the hip pocket by cost of living pressures,” he said.

As crypto firms are

Read more on cointelegraph.com