Crypto world stabilizes after rocky week shakes stablecoins

Crypto assets have been swept up in broad selling of risky investments on worries about high inflation and rising interest rates, but have started showing signs of settling. Although the near-term trajectory of the crypto market is challenging to predict, the worst may be over, said Juan Perez, director of trading at Monex USA in Washington.

Presented ByDid you Know?

Apparel maker Gap has launched NFTs for its iconic hoodies. The more than 50-year-old company's push to sell virtual assets for real money follows similar moves by clothing companies such as Nike

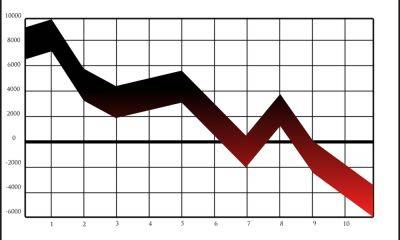

View Details »«Perhaps now that all the obstacles to global growth along with monetary tightening are clear, perhaps we will start seeing swings upwards,» he said. Bitcoin, the largest cryptocurrency by market value, last rose 4.85% to $29,925, rebounding from a December 2020-low of $25,400 which it hit on Thursday. Although it hit a high of just under $31,000 on Friday, bitcoin remains far below week-earlier levels of around $40,000 and unless there is a huge weekend rally it is on track for a record seventh consecutive weekly loss. Stifel chief equity strategist Barry Bannister said bitcoin still has further downside to about $15,000. «Bitcoin is also GDP-sensitive, because bitcoin falls when the PMI Manufacturing index drops, as we expect (into the third quarter of 2022), indicating that a last, capitulatory bitcoin drop may be still ahead,» he added. Ether, the second largest cryptocurrency in terms of market cap, also gained, climbing 6.48% to $2,051.Tether, the biggest stablecoin whose developers say is backed by dollar assets, was back at $1, after falling to 95 cents on Thursday. TerraUSD, however, the stablecoin that is also supposedly pegged to the dollar,

Read more on economictimes.indiatimes.com

economictimes.indiatimes.com

economictimes.indiatimes.com

![How Avalanche’s [AVAX] partnership with Chainlink [LINK] cost it over 25%](https://finance-news.co/storage/thumbs_400/img/2022/6/13/29368_6u33.jpg)