Despite ETC hashrate facing 2023 lows, here’s why day traders remain bullish

At 106.59TH/s, Ethereum Classic’s [ETC] hashrate has hit its lowest point so far this year, data from 2miners.com revealed. Moreover, the chain’s network difficulty at 1.45P also declined to its lowest value since the year began.

Read Ethereum Classic’s [ETC] Price Prediction 2023-24

A network’s hashrate refers to the computing power used by miners to validate transactions and secure the network. On the other hand, network difficulty is a measure of how hard it is to find a block on the blockchain. As more miners join the network and the hashrate increases, the difficulty also increases to maintain a consistent block time.

When a blockchain’s hashrate and network difficulty continue to drop, it suggests that the network is becoming less secure and potentially more vulnerable to attacks. It could also indicate a lack of interest or profitability for miners to continue mining the blockchain.

This might be the case for the ETC network, as data from Messari revealed stagnancy in miners’ revenue from fees paid to process transactions on the blockchain. On a year-to-date basis (YTD), this has oscillated between 0.02% and 0.03%. It rallied to a high of 0.16% on 13 March but declined soon afterward. At press time, this was a mere 0.015%.

Source: Messari

At press time, ETC traded at $20.61. Moreover, increased buying was spotted during a 12-hour window period. ETC’s price traded close to the upper band of the Bollinger Band indicator, suggesting that day traders have increasingly accumulated the alt.

Further, the asset’s Relative Strength Index (RSI) was 56.99, while its Money Flow Index (MFI) rested at 57.92 When both the RSI and MFI indicators of an asset are up, it suggests strong buying pressure in the market, which can

Read more on ambcrypto.com

![Ethereum [ETH] becomes traders’ current favorite because of this reason](https://finance-news.co/storage/thumbs_400/img/2023/3/24/61341_ambp1.jpg)

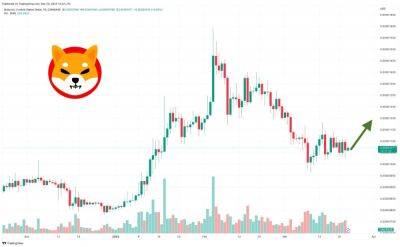

![Shiba Inu’s [SHIB] slump may continue despite increased demand: Here’s why](https://finance-news.co/storage/thumbs_400/img/2023/3/24/61335_vep.jpg)