Digital Assets Not Akin To Gambling Or Lottery: Crypto Firm Director

Virtual assets are not akin to gambling or lottery: Crypto Firm Director

The government is considering taxing cryptocurrencies at par with casinos, lotteries, betting and racecourses, according to a media report, but Aritra Sarkhel, Director for Public Policy at WazirX, a big Indian crypto exchange, said digital assets could not be put under that category.

According to that media report, the Goods and Services Tax (GST) Council, which is the top decision-making body on indirect taxes, is considering levying 28 per cent GST on cryptocurrencies, with the GST Council likely to discuss the proposal at its upcoming meeting. However, the date of that meeting is not finalised yet.

"Virtual Digital Assets (VDAs) are an asset class with varied use cases across industries. It's not akin to gambling or lottery as being made out," said Aritra Sarkhel, Director for Public Policy at WazirX, on the government mulling a 28 per cent GST on cryptos.

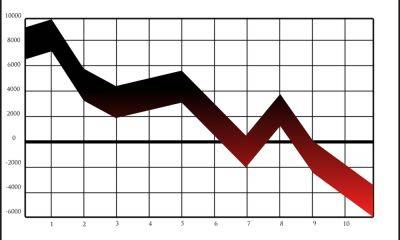

"If we observe the current trends, it is visible that the movement in crypto markets mirrors the other financial markets globally. For example, the recent US Federal Reserve's announcement of increasing rates was followed by a market dip," he added.

That proposed 28 per cent GST would be in addition to an income tax of 30 per cent on earnings from digital assets' transactions, which Finance Minister Nirmala Sitharaman proposed in the Union Budget 2022-23 - to impose a 30 per cent tax on income from the transfer of virtual digital assets. The new income tax rules on digital assets began on April 1.

Gains from virtual digital assets, including cryptocurrencies, are taxable even if a taxpayer's total income is below the threshold limit of Rs 2.5 lakh.

Imposing 28 per cent GST will make cryptocurrencies

Read more on ndtv.com

ndtv.com

ndtv.com

![Is BAYC losing significance with ApeCoin [APE] losing over 34% in a week](https://finance-news.co/storage/thumbs_400/img/2022/6/12/29353_r38l.jpg)