DTCC and Chainlink Launch Pilot Program with US Banking Giants to Advance Tokenization in TradFi

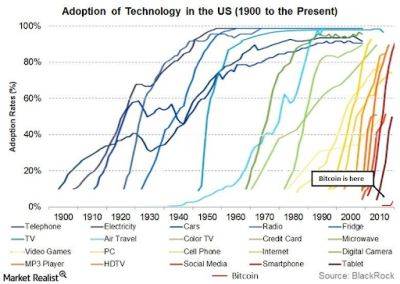

The Depository Trust and Clearing Corporation (DTCC), the largest settlement system in the world, has partnered with blockchain oracle Chainlink to conclude a pilot program involving several major banking firms in the United States.

The primary objective of the program was to enhance the tokenization of traditional finance funds.

The pilot program, known as the Smart NAV Pilot, focused on establishing a standardized method for providing net asset value (NAV) data of funds on blockchains.

Chainlink’s Cross-Chain Interoperability Protocol (CCIP) played a key role in achieving this goal.

According to the DTCC’s report, the program demonstrated that structured data could be delivered on-chain, paving the way for various on-chain use cases such as tokenized funds and “bulk consumer” smart contracts, which hold data for multiple funds.

The successful outcomes of the pilot program have implications for future industry exploration and enablement of numerous downstream use cases.

These include brokerage applications, more automated data dissemination, and easier access to historical data for funds.

The DTCC’s report noted that the program facilitated better-automated data management, minimal disruption to existing market practices in traditional financial institutions, retrieval of historical data without manual record-keeping, and broader API solutions for price data.

Prominent US banking firms actively participated in the pilot program, including American Century Investments, BNY Mellon, Edward Jones, Franklin Templeton, Invesco, JPMorgan, MFS Investment Management, Mid Atlantic Trust, State Street, and U.S. Bank.

Following the release of the DTCC’s report, Chainlink’s native token, LINK, experienced a 12.5% increase in value.

Over the

Read more on cryptonews.com