“ETH ETF Will Not Be Index Preference,” Says Kevin O’Leary

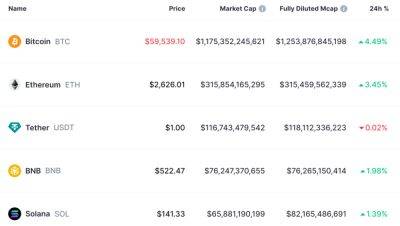

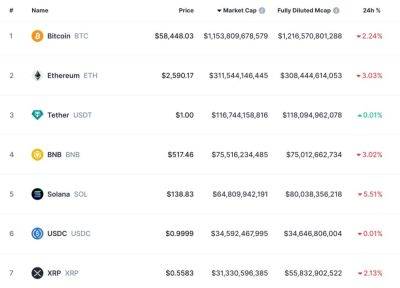

Ether (ETH) soared above $3,500 on July 23 in anticipation of the spot exchange-traded funds (ETFs) that went live for trading today in the United States.

Ether ETFs from VanEck, Franklin Templeton, Fidelity, 21Shares, and Invesco began trading on Cboe. BlackRock’s ETH ETF began trading on the Nasdaq. Products from Bitwise and Grayscale Investments also started trading on the New York Stock Exchange today.

Kevin O’Leary – a venture capitalist and CNBC personality known as “Mr. Wonderful” – told Cryptonews that the spot ETH ETFs would not be the index preference, however.

“When you are an institution that has never done anything with crypto, and now you have two options, you will go to the grandaddy first and put 3.5% weighting into Bitcoin,” O’Leary said.

O’Leary added that investors interested in the newly approved US spot ETH ETFs may allocate 5% weighting into both Bitcoin and Ether ETFs.

O’Leary’s prediction aside, Yahoo Finance data compiled by The Block Pro Research shows that the ETH ETFs accumulated $205 million in combined trading volume less than an hour after trading went live.

Additionally, crypto market maker Wintermute said the new spot Ether exchange-traded funds (ETFs) could see annual flows in the $4.8 – $6.4 billion range . This in turn could result in a 17.9% to 23.87% price increase in Ether.

Eric Balchunas, Bloomberg Senior ETF Analyst, provided additional context. Balchunas posted on his official X account that after 90 minutes of trading, $361 million had been allocated into funds.

Here's where we at after 90 minutes. $361m total. As a group that number would rank them about 15th overall in ETF volume (about what $TLT and $EEM trade), which is Top 1%. But again compared to a normal ETF

Read more on cryptonews.com