Ethereum Price Prediction as Developers Consider Raising Validator Limit from 32 to 2,048 Ether – How Will ETH Price React?

The Ethereum price has inched upwards by 0.4% in the past 24 hours, rising to $1,729 after Ethereum developers proposed raising the deposit requirement for validators from 32 to 2,048 ETH.

The aim of this proposal – which represents an increase of 6,300% – is to reduce waiting times for setting up a validator node, which currently stands at just over 40 days.

However, increasing the requirement may further increase the centralization of staking, which could increasingly become the preserve of larger holders and platforms.

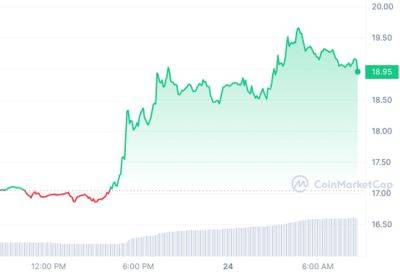

This possibility doesn't seem to have affected the ETH price, however, with the altcoin down by only 1% in a week and yet up by 54% in the last 12 months.

Ethereum's chart suggests that the coin may be close to a recovery, with its indicators beginning to show a little life after the SEC-caused slides of the past couple of weeks.

Its 30-day moving average (yellow) has begun climbing again towards its 200-day average (blue), implying that it may rise all the way up in parallel with ETH's price.

At the same time, the altcoin's relative strength index (purple) has returned to 50 after spending the end of last week at or below 30, which suggests overselling.

This means that ETH is in a position to rally again, a view also suggested by its support level (green), which is rising encouragingly.

On the other hand, recent whale data suggests that at least some larger investors may be preparing to sell, with one particular holder sending more than $50 million in ETH to Coinbase today.

Of course, you could just as easily flip this around and argue that this whale is anticipating a rally in the coming days, and may be looking to profit rather than simply 'dump.'

Or you could even suggest that it's being moved to Coinbase for

Read more on cryptonews.com