Exchanges say crypto can help unlock India's economic potential

crypto community, in reaction to central bank governor Shaktikanta Das' statement that private cryptocurrencies are a big threat to India's financial and macroeconomic stability, has said crypto assets could help unlock the country's innovation, job-creation and economic potential. Also, the exchanges said they praised the stance of the central bank and the government that customer protection is a priority. «The good thing is that the government and regulators have been very consultative in their approach to the industry, and there is broad understanding that customer protection is of utmost importance. It is encouraging to see India thinking progressively about crypto at par with global counterparts like the US, Dubai, and Singapore,» said Ashish Singhal, founder and CEO, CoinSwitch.

Presented ByDid you Know?

Sunny Leone took the lead among Indian actors to secure her digital assets when she broke the news about her association with NFT, two months back. This made her the first Indian actress to mint NFTs

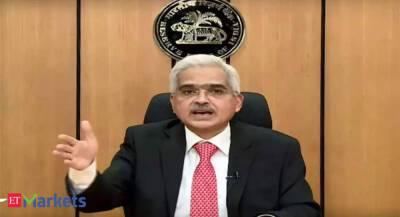

View Details »On Thursday, RBI governor Shaktikanta Das said in press interaction after the monetary policy review that private crypto-currencies were a threat to the macroeconomic and financial stability of the country, and that investors should keep risks in mind as such assets have no underlying value whatsoever — «not even a tulip.» At the same press conference, T Rabi Sankar, the RBI Deputy Governor, also said that the Indian CBDC will be exactly like a normal, physical rupee but digital in nature, and it will be one-to-one convertible. «By creating a central bank digital currency, the government has made it clear that it wants to ring-fence the currency. What it does is that it clearly demarcates currency and

Read more on economictimes.indiatimes.com

economictimes.indiatimes.com

economictimes.indiatimes.com