‘Exhausted all options’ — Unbanked to close after being left hanging by investor

Crypto fintech firm Unbanked, which provides crypto custody and payments services, has become the latest firm to close shop while citing a harsh regulatory environment for crypto in the United States.

In a May 26 blog post, Unbanked co-founders Ian Kane and Daniel Gouldman said that when it first opened, it believed that building the company in the United States “would be the smart long-term play,” though that did not turn out to be the case, five years later.

“While other crypto companies grew rapidly off-shore by avoiding strict regulation, we believed that engaging with regulators and following their arduous processes would ultimately position Unbanked to come out ahead,” said the execs.

Today, we are making the unfortunate decision to wind down Unbanked. Please withdraw your funds (crypto + USD) as soon as possible from your accounts. More details are available here: https://t.co/oWR7m3ZqlM

Instead, this decision led to “a lot of wasted time and excessive costs,” they added.

Unbanked’s decision to wind down operations comes despite the firm inking major deals with other companies in recent months, including a partnership with payments giant Mastercard.

The co-founders said the firm had been expecting $5 million in funding injection, but that still hasn’t materialized. Kane and Gouldman said they believe this is a result of the regulatory climate for crypto in the U.S., which “ultimately limited Unbanked’s ability to raise capital and run a self-sustaining business.”

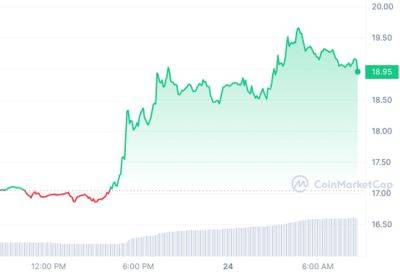

“Three weeks ago Unbanked signed a term sheet for an investment of $5 million dollars at a $20 million valuation that would allow us to not only continue operations but to expand. We have not received those funds as of this moment,” the firm explained.

The

Read more on cointelegraph.com