Fantom Coin is Going to Zero as FTM Price Plummets 15% But All Attention is On Evil Pepe After Raising $160,000 – How to Buy Early?

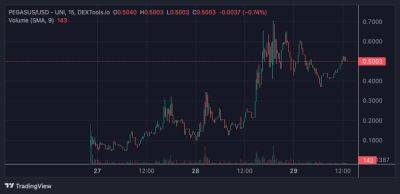

Following a failed recovery rally, Fantom (FTM) is facing a continuation of the bleak price action that has plagued the mid-ranked Layer-1 since May 2022.

A short-lived +230% rally at the start of the year has given way to a multi-month cascading price action, which has seen a tough -60% bleed-out for dedicated Fantom holders.

With Fantom price now trading at a lowly $0.2575 (a 24 hour change of -0.08%) many are now wondering whether FTM is destined to fall to zero.

Indeed, downside momentum has dominated the chart since touching the upper-trendline on April 13, which sent price plummeting below the 20DMA (which has formed a hard ceiling of local resistance ever since).

Worse still, on May 24, a brief period of supportive footing from the 200DMA gave way, leaving price in free-fall to current rock bottom price levels.

Recent attempts to break back above the 20DMA have been slapped-down in tough rejection moves, further adding to the bleak outlook for ongoing price moves.

With price now hovering above the foundation price level at $0.025 - holders are in a state of anxiety - desperate for a fundamental change to the stormy headwinds.

Indicators provide little reassurance, while the RSI is showing bullish divergence at 40.9 - the swift rejections from resistance at the 20DMA on July 5 and July 14 could indicate a need to cool off further to 30.

And this is a view reinforced by the MACD, which shows bearish divergence at -0.0029.

Despite the declining interest, there could be a glimmer of hope in Fantom's risk: reward structure.

Upside potential from here is targeting a reclamation of price level above the 20DMA around $0.31 (a possible +38% move).

While downside risk here is minimised, with strong local support likely to be found at

Read more on cryptonews.com