Fed report on SVB collapse faults bank's managers — and central bank regulators

Silicon Valley Bank's dramatic failure in early March was the product of mismanagement and supervisory missteps, compounded by a dose of social media frenzy, the Federal Reserve concluded in a highly anticipated report released Friday.

Michael S. Barr, the Fed's vice chair for supervision appointed by President Joe Biden, said in the exhaustive probe of the March 10 collapse of SVB that myriad factors coalesced to bring down what had been the nation's 17th-largest bank.

Among them were bank executives who committed «textbook» failures in managing interest rate risk, Fed regulators who failed to understand the depth of SVB's problems and then were too slow to react, and a social media frenzy that may have accelerated the institution's demise.

Barr called for broad changes in the way regulators approach the nation's complex and interwoven financial system.

«Following Silicon Valley Bank's failure, we must strengthen the Federal Reserve's supervision and regulation based on what we have learned,» he said.

«As risks in the financial system continue to evolve, we need to continuously evaluate our supervisory and regulatory framework and be humble about our ability to assess and identify new and emerging risks,» Barr added.

A senior Fed official said increased capital and liquidity might have helped SVB survive. Central bank officials likely will turn their attention to cultural changes, noting that risks at SVB were not thoroughly examined. Future changes could see standardized liquidity requirements to a broader range of banks, and tighter supervision of compensation for bank managers.

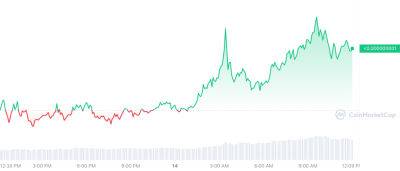

Bank stocks were higher following the report's release, with the SPDR S&P Bank ETF up about 1.3%.

In a stunning move that continues to

Read more on cnbc.com

cnbc.com

cnbc.com