Former Biden Advisor Reveals Administration's Drive Towards Digital Dollar – What's Going On?

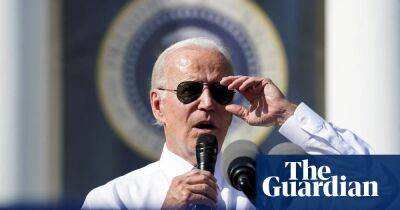

A former top economic adviser for President Joe Biden has revealed that the administration is pushing to launch a digital dollar in a bid to “crowd out” private cryptocurrencies.

During a Tuesday Senate Banking Committee hearing, Daleep Singh, a former deputy national security adviser for international economics in the Biden administration, said a digital dollar would remove the need for the cryptocurrency ecosystem that facilitates ransomware attacks and sanctions violations.

Singh, who was serving as the president when the administration issued an executive order to encourage U.S. regulation of digital assets in March last year, said the order was aimed at bringing more regulation to tackle ransomware attacks and other risks coming from crypto assets.

He added that as an advisor he was also "trying to push our government to launch a digital dollar, which I think is the single best step that we could take because it would crowd out the ecosystem of crypto that allows national security adversaries like Russia to exploit our deficiencies, our weaknesses in terms of our critical infrastructure."

Singh claimed that the U.S. government embracing a central bank digital currency (CBDC) “is the single best step that we could take [to protect national interests] because it would crowd out the ecosystem of crypto.”

A central bank digital currency (CBDC) is a digital currency issued by a central bank. As per data by the American think tank Atlantic Council, a total of 11 countries have launched a digital currency, which includes countries like The Bahamas, China, Nigeria, and Jamaica, among others.

Notably, 105 countries, representing over 95% of global GDP, are exploring a national digital currency. In comparison, only 35 countries

Read more on cryptonews.com

cryptonews.com

cryptonews.com