Genesis' bankruptcy filing was decided by independent committee according to DCG

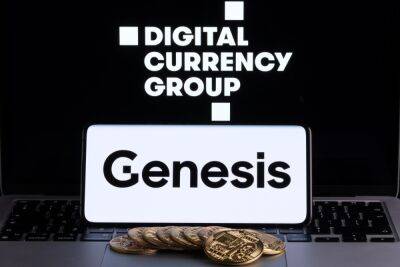

Genesis Capital's parent company Digital Currency Group (DCG) denied involvement in Genesis' bankruptcy filing in a statement on Jan. 20. According to DCG, a special committee of independent directors recommended and decided to file for Chapter 11 bankruptcy protection.

Filing for Chapter 11 will allow Genesis to seek the reorganization of debts, assets and other business activities. The company estimated liabilities of $1 billion to $10 billion, along with assets in the same range. DCG noted in the statement that:

Only Genesis lending entities (Genesis Global Holdco, Genesis Global Capital, and Genesis Asia Pacific - collectively known as “Genesis Capital”) have filed for bankruptcy protection. Genesis Global Trading and Genesis’ spot and derivatives trading entity will remain operational.

DCG Statement on Genesis Capital Chapter 11 Bankruptcy Filing: https://t.co/6SsWj4zo3R pic.twitter.com/j9e8R3mMZv

Related: Crypto Biz: DCG’s ‘carefully crafted campaign of lies’?

DCG said it intends continue to operate as usual, as per the statement, along with its other subsidiaries, including Grayscale Investments, Foundry Digital, Lino Group Holdings, CoinDesk, and TradeBlock Corporation.

In a letter sent to shareholders on Jan. 17, DCG confirmed it owes "$526 million due in May 2023 and $1.1 billion under a promissory note due in June 2032." The company noted that it intends to address obligations to Genesis Capital in the course of a restructuring. The letter also announced a halt to quarterly dividend payments to preserve liquidity, Cointelegraph reported.

Genesis' problems became apparent after the withdrawal halt in November, which it blamed on "unprecedented market turmoil" that followed the collapse of FTX. The company later

Read more on cointelegraph.com