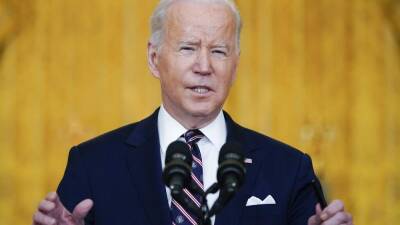

Global markets tumble as Russia-Ukraine tensions hit shares

Mounting fears of an imminent Russian attack on Ukraine triggered a global share sell-off on Monday, and prompted oil prices to hit a seven-year high.

European markets followed Asian shares sharply lower, with the UK’s FTSE 100 down 160 points, or 2%, at 7,501 in morning trading. Travel-related stocks were hardest hit, including the British Airways owner, IAG, which was the biggest faller on London’s blue-chip index, down 7%. The jet engine maker Rolls-Royce was down 4%, as only five companies on the FTSE 100 made it into positive territory.

There were heavy falls across Europe, led by Germany’s Dax, which was down 3.7%. Italy’s FTSE MiB, France’s Cac and Spain’s Ibex all fell by about 3.5%.

Heightened expectations of a Russian invasion of Ukraine prompted renewed fears of disrupted energy exports at a time when the market is already tight. It drove the price of Brent crude oil to above $96 (£71) a barrel for the first time since September 2014, before easing back to $94.

Analysts are not ruling out a breach of the $100 mark as tensions rise, with the price of oil up 23% since the start of 2022. Natural gas prices also soared 4.9%.

Russia is responsible for a third of Europe’s natural gas and about 10% of global oil production.

“Just as the storm of Covid appeared to be receding, the growing expectation of an invasion of Ukraine is the fresh threat now unnerving investors,” said Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown. “Energy markets are clearly on edge and if supplies are threatened there is a risk oil will shoot up even higher, adding price pressure for companies.”

The falls in European shares prices followed a sell-off in Asia. Hong Kong’s benchmark Hang Seng index fell by about 1.7%,

Read more on theguardian.com

theguardian.com

theguardian.com