Global Surge in CBDC Exploration Leaves US Playing Catch-Up: Study

An Atlantic Council study published Thursday showed that 134 countries, or 98% of the global Gross Domestic Product (GDP), are currently exploring a central bank digital currency (CBDC). This number has surged from just 35 since May 2020.

Currently, 68 countries are in advanced stages of exploration, which includes development, pilot, or launch phases.

Notably, most G20 nations, excluding Argentina, are in advanced stages, with 11 already in the pilot phase. These nations include Brazil, Japan, India, Australia, South Korea, South Africa, Russia, and Turkey.

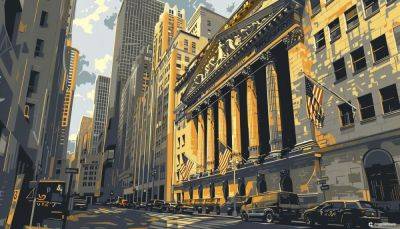

In contrast, advancements in a retail CBDC have halted in the US. Federal Reserve Chair Jerome Powell recently conveyed to the Senate Banking Committee that the Fed currently has no immediate intentions to introduce such a currency.

“People don’t need to worry about a central bank digital currency. Nothing like that is remotely close to happening anytime soon,” he said.

Lawmakers have expressed concerns about US citizens’ privacy, which has hindered efforts to introduce the digital dollar.

China’s digital yuan (e-CNY) stands out as the largest CBDC pilot globally. With its widespread adoption, the e-CNY has reached 260m wallets across 25 cities.

Meanwhile, the European Central Bank (ECB) is actively working on the development of CBDC and eyeing a launch in 2025. This involves conducting practical tests and trials to ensure the functionality and security of the digital euro.

As of now, only three countries have successfully launched a CBDC: the Bahamas, Jamaica, and Nigeria. The Eastern Caribbean Currency Union, comprising 8 countries, encountered technical issues with its DCash initiative and consequently suspended its availability. The union is now in the process of

Read more on cryptonews.com