Grayscale Drops Update on GBTC Spot Bitcoin (BTC) ETF Approval – Get Ready for Ethereum (ETH) and Everlodge (ELDG) Price Surge

Grayscale, a prominent name in the crypto investment sphere, recently made waves with its update on the approval status of the Grayscale Bitcoin Trust’s (GBTC) Spot Bitcoin ETF. This long-awaited development has sparked anticipation and excitement. Meanwhile, Ethereum (ETH) and Everlodge (ELDG) are seeing price surges. Let’s discover why.

Grayscale’s recent update on the potential approval of a GBTC conversion to a spot Bitcoin (BTC) ETF has caused optimism within the crypto community. Its confidence in the impending approval by the SEC adds weight to the growing belief that regulatory acceptance of a spot Bitcoin ETF in the United States is now a question of ‘when,’ not ‘if.’

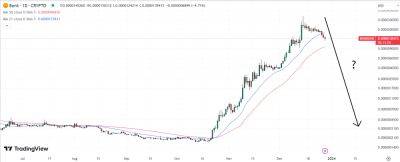

After this Bitcoin news, its value increased from $38,780 on December 1st to $38,389 on December 2nd. This is an impressive 11.62% increase over the last 30 days. There are also 29 technical indicators flashing green.

The collective optimism surrounding the Bitcoin price surge is sky-high, with experts making bullish price predictions. They project a climb to $41,474.39 by the conclusion of 2023. This bullish forecast and Grayscale’s confident assertions amplify the anticipation for its ETF.

Ethereum (ETH) recently showed notable signs of bullish activity, signaling potential upward movement within the crypto market. Analyst Ali Martinez reveals a striking trend: Ethereum whales have accumulated tokens in nine consecutive days for the first time in nine months. This ETH accumulation by whales often indicates upcoming bullish Ethereum price action.

In recent market movements, Ethereum’s price has displayed promising growth, surging from $2,077 on November 25th to $2,128 on December 2nd. Ethereum recorded 17 out of 30 days in the green throughout the

Read more on cryptonews.com