Here's the deflation breakdown for July 2024 — in one chart

Inflation cooled below 3% in July 2024, the first time it dropped beneath that level in more than three years.

While many areas of the U.S. economy are dis-inflating — meaning their prices are still rising, though at a slower rate — some have been outright deflating. That means their prices have actually declined.

Deflation has largely occurred for physical goods, though it has also appeared in categories like airline fares, gasoline and various food items, according to the consumer price index.

These are «micro pockets» of deflation, said Joe Seydl, senior markets economist at J.P. Morgan Private Bank.

But the deflationary dynamic is less widespread than it was earlier in the pandemic, when the unwinding of contorted supply-and-demand dynamics made it more pronounced, economists said.

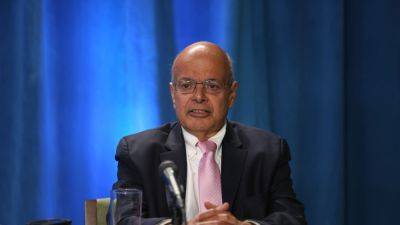

«Broadly speaking, deflation for various items is increasingly less broad-based,» said Mark Zandi, chief economist of Moody's.

Consumers shouldn't expect a broad and sustained fall in prices across the U.S. economy. That generally doesn't happen unless there's a recession, economists said.

«Core» goods — commodity prices excluding those related to food and energy — have declined by about 2% since July 2023, on average, according to CPI data.

They fell 0.3% during the month, from June to July 2024.

Demand for physical goods soared in the early days of the Covid-19 pandemic as consumers were confined to their homes and couldn't spend on things such as concerts, travel or dining out.

The health crisis also snarled global supply chains, meaning goods weren't hitting the shelves as quickly as consumers wanted them.

Such supply-and-demand dynamics drove up prices.

The environment has changed, however.

To that point, the initial pandemic-era

Read more on cnbc.com

cnbc.com

cnbc.com