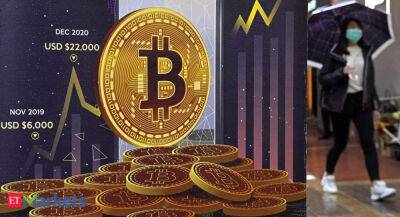

How crypto market bloodbath triggered outflows over $100M over the past week

Just a week can completely change the entire outcome in the cryptocurrency market. A report posted on 7 June, revealed that digital assets witnessed inflows last week despite the bearish run. This inflow amounted to $100 million bringing the total assets under management (AuM) to $39.8 billion.

But, the said inflow didn’t stay for long…

The cryptocurrency market is undergoing a heavy correction phase that saw the market quit the ‘Trillion’ zone. At press time, the overall market stood at the $959.7 billion mark after suffering a 14% correction in 24 hours.

As expected, digital assets saw outflows of $102 million last week as per CoinShares’ latest Digital Asset Fund Flows Weekly report. Given the negative sentiment across crypto, the blog noted:

“Digital asset investment products flows remain choppy in anticipation of hawkish monetary policy, with steady daily outflows last week totalling US$102m.”

Here’s a graphical representation:

Source: CoinShares

Geographically speaking, the majority of outflows focused on the Americas, totaling $98 million with Europe seeing just $2 million outflows.

Surely, looks like it.

Bitcoin saw outflows totaling $57 million last week bringing month-to-date outflows to $91 million. Interestingly, despite these outflows, short-bitcoin investment products also saw minor outflows totaling $0.2 million. Nevertheless, the total AuM stood much lower at $55 million compared to $27 billion for long-long bitcoin investment products.

Source: CoinShares

According to the blog, an important factor led to BTC’s demise:

“What has pushed Bitcoin into a “crypto winter” over the last 6 months can by and large be explained as a direct result of an increasingly hawkish rhetoric from the US Federal Reserve.”

Even Terra’s

Read more on ambcrypto.com

ambcrypto.com

ambcrypto.com