How Liz Truss plunged the UK to the brink of recession in just one month

Britain’s new prime minister, Liz Truss, has been in office for less than a month, but her premiership is already deep in crisis, while Britain teeters on the brink of recession.

Truss took over from Boris Johnson at the start of September and was immediately plunged in at the deep end, with the death of Queen Elizabeth II. But the 10-day national period of mourning came to an end abruptly.

Determined to quickly make her mark, Truss announced a radical new economic agenda of tax cuts and spending worth tens of billions of pounds funded by borrowing – the true total of which is still not known.

The move, which appeared to also violate public sending curbs, tore apart the orthodoxy established by the three Conservative prime ministers who went before her during 12 years in power that tried to emphasise fiscal prudence.

Truss’s drive for growth proved too radical for traders. The pound was sent spiralling to reach its lowest value against the US dollar, an embarrassing intervention from the central bank – the Bank of England – was made to avoid a raid on pension funds, and rebukes from foreign observers, including the International Monetary Foundation, were swift.

A “new era” was promised – and that is certainly what has happened, but not in the way many expected.

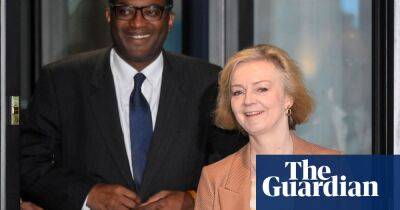

The damage was done just a week ago, when the chancellor, Kwasi Kwarteng, stood up in the House of Commons to present what was billed as a “mini-budget”.

As well as a huge energy support package for businesses fearing they would be unable to afford soaring bills this winter, a number of controversial measures were also announced – including abolishing the top rate of tax and scrapping the cap on bankers’ bonuses.

In total, it was the biggest tax-cutting package for 50

Read more on theguardian.com