Is dYdX Going to Zero? DYDX Price Plunges 7% as Fresh Altcoin Races Past $450,000 Milestone

Leading crypto DEX dYdX has seen native token DYDX tumble -7% in tumultous loss of 20DMA support, but is dYdX going to zero? Find out here.

The sudden drop has left dYdX holders reeling, as the token enters the biggest losers for October 11 - beaten only by top tokens IOTA and Tezos.

Yet, the fall in price comes as dYdX's prominence in the DEX space grows, with the platform facilitating vast quantities of trading volume over the past month.

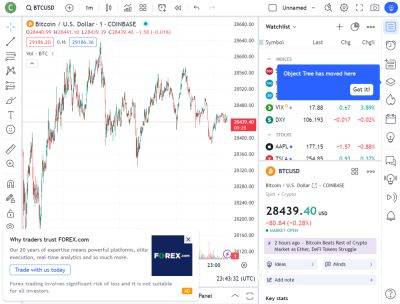

In the aftermath of the sudden -7% drop, dYdX is currently trading at a market price of $1.90 (representing a 24-hour change of +0.05%).

This comes as price collapses back below the 20DMA ($1.95), which has provided supportive footing for much of the past week as dYdX crypto price has pushed up to test resistance from the 200DMA (sat at $2.12).

The emergence of this tight-range between the 20DMA and 200DMA has been critical for price action over the last 3-months, with movements trapped in a ranging pattern above the $1,825 price level since June 21.

This comes following a 'death cross' pattern on May 25, which saw the 20DMA drop below the 200DMA.

Turning our attention to indicators, the RSI has flipped back to an oversold signal with the recent downside move, now signalling bullish divergence at 44.43.

While the MACD has flipped to bearish divergence at -0.002 in a sign of stalling momentum.

Overall, dYdX seems likely to remain in the increasingly well-established ranging pattern, with dYdX bulls targeting a push back above the 20DMA.

On the short-time frame this leaves an upside target at $2.00 (a possible +4.71%).

While downside risk could see price fall to lower support at $1.825 (a potential -4.45%).

This leaves dYdX with a risk: reward ratio of 1.06 - a mediocre entry with little upside

Read more on cryptonews.com