Is it Too Late to Buy Ethereum? ETH Price Falls after Twitter Founder Jack Dorsey Says Ethereum is a Security – Here's Why yPredict AI Crypto Signals Platform

In the world of cryptocurrencies, stability is a luxury and now Ethereum (ETH), the world's second-largest cryptocurrency, has found itself at the heart of an escalating debate over regulatory clarity following a wave of enforcement actions by the U.S. Securities and Exchange Commission (SEC).

The SEC recently launched lawsuits against two of the world's largest crypto exchanges, Coinbase and Binance, alleging they traded assets considered securities without the requisite registration.

The assets implicated in this ongoing controversy include Solana (SOL), Cardano (ADA), Binance Coin (BNB), and Polygon (MATIC), sparking worries over Ethereum's future price action.

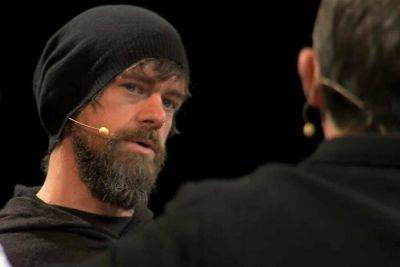

Adding fuel to the fire, Jack Dorsey, founder of Twitter and known Bitcoin advocate, raised eyebrows when he suggested that Ethereum should also be classified as a security.

While the tweet has sparked a fierce debate online, its impact on Ethereum's price has been unquestionable.

The suggestion, whether it finds regulatory support or not, however, contributes to a sense of uncertainty that often leads investors to shy away from impacted assets.

Beyond the crypto-specific issues, Ethereum's price is also feeling the pressure from broader economic factors.

The U.S. Labor Department reported a surge in jobless claims, a clear sign of slowing labor market momentum.

With 261,000 new applications for unemployment benefits, the latest figures came in well above the 235,000 predicted by economists, fueling recession fears and applying downward pressure on Ethereum's price.

In light of the legal headwinds tearing through the industry, Ethereum is currently trading at $1,844 (+0.66%) as topside resistance seems to be forming an unbreakable ceiling of resistance on the short time

Read more on cryptonews.com