Is it Too Late to Buy Shiba Inu? Crypto Experts Give Their SHIB Price Predictions

Shiba Inu (SHIB), one of the most popular Ethereum-based ERC-20 tokens and the second largest dog-inspired meme coin by market capitalization after Dogecoin, has come off the boil on Monday. SHIB/USD was last changing hands just over 3.5% lower on Monday in the mid-$0.000011s, now down about 10% from earlier monthly peaks near the $0.000013 level.

Broad downside in crypto markets and across risk assets in the traditional finance space amid caution ahead of a massive week of macro risk events (including Fed, ECB and BoE meetings plus US jobs, ISM and Consumer Confidence data) is the main factor weighing on SHIB on Monday. But the crypto token is still on course to have gained a massive more than 43% this month, which would be its best month since October 2021, when it rocketed a stunning 830% higher.

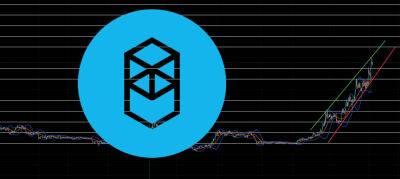

Since Shiba Inu’s break above its 200-Day Simple Moving Average (SMA) earlier this month – the first sustained break above this level since 2021 – the bulls have been getting louder. However, they should beware that, earlier this month, SHIB saw a significant bearish technical development.

SHIB/USD confirmed a downtrend linking the August, October 2022 and January 2023 highs, which suggests the cryptocurrency’s near-term bias could be to the downside. If this week’s macro events weigh on crypto (say the Fed comes across as much more hawkish than expected), then SHIB traders should watch for how the crypto token reacts to the $0.000011 support area. A break below here could open the door to a return under $0.000010.

According to Cryptonews.com analyst John Isige, a break above the above noted chart pattern would open the door to a test of the October and August peaks at the $0.000015 and $0.000018 levels respectively. Isige

Read more on cryptonews.com