Is It Too Late to Buy Tezos? XTZ Price Rallies 9% as New Telegram Crypto Casino Raises $725,000

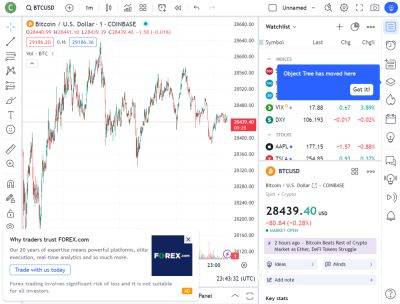

Tezos (XTZ) has seen impressive volatility over the past 48-hours, appearing in both the top gainers and top losers this week, but as price action saddles the 20DMA - is it too late to buy Tezos?

A dramatic +15.8% move yesterday was swiftly followed by an equally dramatic -10.72% drop last night.

Yet, amid the volatility - there appears to be little Tezos fundamental news driving the sudden movements.

Analysts speculate the move could have been triggered by a marketing push on Tezos' Manchester United NFTs - however, other analysts suggest the move has simply been fuelled by an unexpected surge to $158m in trading volume.

Following the lively price action, Tezos is currently trading at a market price of $0.66 (representing a 24-hour change of -3.48%).

The downside move comes following rejection from upper trendline resistance at $0.75, a level untouched since August 16.

Strong footing atop the 20DMA (stood at $0.67) has provided a 14-day consolidation zone, triggering the upside swing.

However, tumultous rejection has seen price action fall below 20DMA support this morning, in a worrying display that could signal further downside action on the horizon.

The last time XTZ dropped below the 20DMA on July 24, price action headed south for more than 65 days, with divergence below the moving average peaking at -28% below the 20DMA on August 18.

Meanwhile, the 200DMA - a level untouched since April 29 - is still trading high above the upper trendline at $0.84.

Despite the volatility, the RSI has only risen at a gradual rate with the leading indicator currently showcasing minor bullish divergence at an oversold 47.80.

The MACD also reflects minor bullish divergence at 0.001.

Overall, Tezos looks primed to catch support here - XTZ's

Read more on cryptonews.com