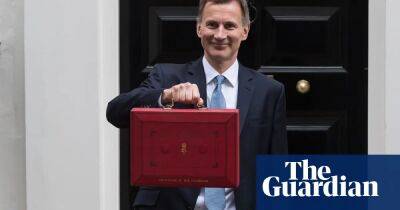

Jeremy Hunt’s ‘bizarre’ ditching of pension limit ‘widens inheritance loophole for wealthy’

Jeremy Hunt’s budget decision to scrap the limit on pensions savings has been criticised as “bizarre” by the UK’s leading economics research institute, which says it creates an unjustified extra inheritance tax loophole for high earners that should be closed as soon as possible.

The Institute for Fiscal Studies (IFS) says that following last week’s budget many people on high incomes will now be able expand their pension pots in order to pass on hundreds of thousands of pounds more to their loved ones, tax free, when they die. The IFS says the purpose of pensions savings should be to fund retirement incomes not to escape tax.

In the budget, Hunt abolished the pensions lifetime allowance, which is the limit on how much people can build up in their pots over their lifetime. Previously, anything over £1.07m was subject to a tax charge of up to 55%. The limit applied to all personal and workplace pensions but excluded the state pension, and was due to be frozen at its current level until 2026. Instead of increasing the allowance, as had been expected, the chancellor scrapped it altogether.

He also increased the annual allowance – which is the maximum someone can save in a pension pot in a single tax year before having to pay tax – from £40,000 to £60,000.

The Treasury says it acted because the lifetime allowance led many professionals, such as NHS consultants and GPs, to retire early on reaching the limit, creating a staffing crisis.

Official budget documents show that abolishing the lifetime allowance will cost the Treasury a total of £2.75bn over five years. Isaac Delestre, research economist at the IFS, said the whole policy of exempting pensions savings from inheritance tax was wrong and should be reformed by government.

“Whate

Read more on theguardian.com