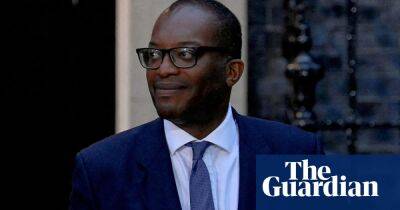

Kwasi Kwarteng announces sweeping tax cuts in mini-budget

Cuts to the top rate of tax, national insurance, and stamp duty were announced by the government.

A 1p tax cut planned in the basic rate of income tax for 2024 will be brought forward to 2023, and the top rate of 45% is being scrapped, so the highest rate will be 40%.

A national insurance rise of 1.25% will be cancelled, saving households £330 a year.

Stamp duty thresholds will be increased, cutting the tax paid on purchasing homes. The £500,00 threshold will rise from £500,000 to £650,000. He said the cuts would be permanent.

Promising a new era of of growth, he said: “High taxes reduce incentives to work and they hinder enterprise.”

Against a backdrop of high inflation and forecasts that Britain faces a long recession, the chancellor cancelled a rise in corporation tax to 25% next year

“In the context of the global energy crisis it is entirely appropriate for the government to take action,” he said, adding that “fiscal responsibility remains essential” and he would be allowing the Office Budget Responsibility to examine the Treasury’s spending plans.

Read more on theguardian.com