Losses from crypto rug pulls outpaced DeFi exploits in May: Finance Redefined

Welcome to Finance Redefined, your weekly dose of essential decentralized finance (DeFi) insights — a newsletter crafted to bring you the most significant developments from the past week.

May was a month filled with exit scams in the DeFi world, with over $45 million lost to exit scams, while exploits on DeFi protocols racked up less than half that amount over the same period.

Uniswap DAO rejected a plan to charge liquidity provider fees as Uniswap (UNI) token holders, citing tax concerns. The proposal would have allowed Uniswap’s governing body to receive a percentage of the fees currently going to liquidity providers.

Jimbos Protocol has offered an $800,000 bounty to the public as talks with the hacker failed. The protocol’s team extended the bounty offer to the public, inviting anyone who could help catch the exploiter or recover the funds to claim the reward. The Fantom network has started paying developers to generate gas fees, and another popular DeFi protocol, PancakeSwap, has entered the GameFi space.

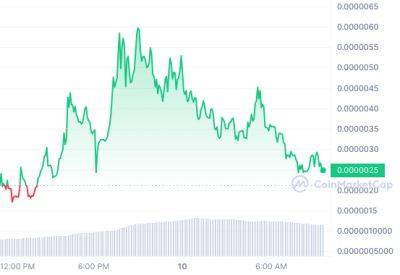

The top 100 DeFi tokens had a bullish last week of May, with most of the tokens recovering from two weeks of bearish pressure. The total value locked in DeFi protocols also rose above $50 billion again.

The amount of cryptocurrency lost to rug pulls, or exit scams, where founders suddenly up and leave with investors’ money, had outpaced the amount stolen from DeFi projects in May, a blockchain security firm has revealed. A June 1 report from Beosin said total losses from rug pulls and scams reached over $45 million across six incidents in May.

Meanwhile, 10 attacks on DeFi protocols netted just $19.7 million. The amount is an almost 80% decrease from April, with losses from these types of exploits declining for two

Read more on cointelegraph.com

cointelegraph.com

cointelegraph.com