North Sea’s biggest energy producer says UK windfall tax wiped out surge in profit

The North Sea’s biggest producer has hit out at the windfall tax on oil and gas companies after a near 700% surge in profits to $2.5bn (£2.1bn)) was “all but wiped out” by the levy.

Harbour Energy said on Thursday its pre-tax profits had risen sharply from $315m in 2021 to $2.5bn in 2022, a 682% year-on-year increase. However, its after-tax profits fell from $101m in 2021 to just $8m in 2022.

Harbour becomes the latest oil and gas company to report a huge increase in underlying profits, after the war in Ukraine pushed up wholesale gas prices and sent household bills soaring.

Last month, BP and Shell reported record profits for 2022, prompting calls for the energy profits levy to be adjusted to capture a greater proportion of their profits.

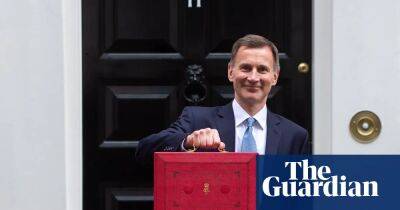

However, Harbour has seen its shares slide since the windfall tax was toughened by chancellor Jeremy Hunt in November and has been a vocal critic of the levy.

Chief executive Linda Cook said production rates, margins and safety had improved.

Cook added: “However, the UK energy profits levy, which applies irrespective of actual or realised commodity prices, has disproportionately impacted the UK-focused independent oil and gas companies that are critical for domestic energy security.

“For Harbour, the UK’s largest oil and gas producer, it has all but wiped out our profit for the year. This has driven us to reduce our UK investment and staffing levels.

Sign up to Business Today

Get set for the working day – we'll point you to all the business news and analysis you need every morning

after newsletter promotion

“Given the fiscal instability and outlook for investment in the country, it has also reinforced our strategic goal to grow and diversify internationally.”

The Guardian revealed last year that

Read more on theguardian.com

![Ripple [XRP] falls to psychological support level: Can bulls step up soon](https://finance-news.co/storage/thumbs_400/img/2023/4/1/62544_g2qq.jpg)